In the current economic and business environment, liquidity and accounts receivable has emerged as a topic of concern. Making sales is important, but collecting on those sales is critical.

A recent survey by the Credit Research Foundation showed that 93% of respondents believed that their customers were relying on suppliers for working capital.

Other key findings of the survey:

- 81% felt that their customers experienced a tightening of available bank financing

- 66% stated they were experiencing more customer bankruptcies than a year ago

- 76% stated that the Federal Economic Stimulus Package had no impact on their business

Value of a Credit and Collections Policy

If you don’t have a credit and collections policy, or if you haven’t reviewed your policy in awhile, it’s time to get started.

Effectively managing accounts receivable is about ensuring consistency in your credit and collection processes. The secret to this consistency is designing and actively implementing a credit and collection policy. Properly constructed and applied, this policy has the power to breathe new life into your entire credit-to-cash process. An old policy, however, that hasn’t been reviewed under the current conditions may be doing your company more harm than good.

Develop a Mission Statement

A thoughtfully designed mission statement is basic to a functional credit and collection policy. It should express the long-range focus of the policy and define the purpose of the credit department.

The mission statement may also include the philosophy under which the credit department will approach the credit process, providing a general guideline for dealing with risk and collections. Whether liberal, moderate, or conservative, it should reflect the general direction of the company overall.

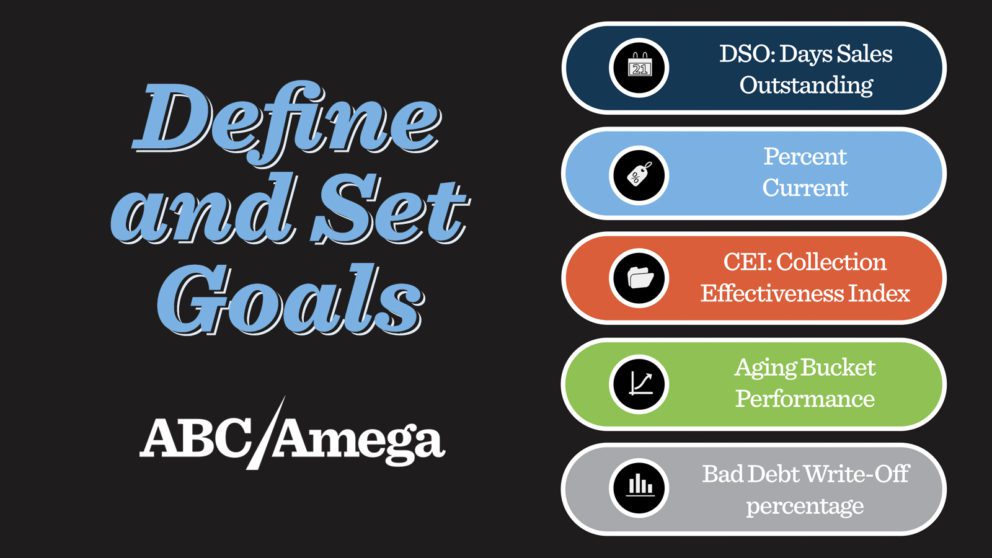

Define and Set Goals

Credit department goals for the coming year should be included in the policy. Goals should track with current market conditions and the strategic direction of your organization. They should be reviewed and updated annually. Many organizations use the following in establishing goals:

Measure to Manage

Goals must be linked to targets in order to function as drivers for the improvement of accounts receivable management. As such, they need to be monitored and measured against established metrics. Benchmarking statistics for the appropriate levels of performance for your organization can be found in the Credit Research Foundation’s Quarterly National Summary of Domestic Trade Receivables, where they are listed by industry.

Use the ‘5 C’s of Credit’ to help measure against your organization’s goals

- Character – Willingness to pay

- Capacity – Will they keep it

- Capital – Do they have it

- Collateral – What backs it up

- Conditions – Status of the current economy

Goals and performance against goals should be communicated on a regular basis to the entire credit organization.

An effective way to monitor and share performance results is to create a graphical representation of statistical data, such as a Pareto analysis. This can be done by segmenting your A/R portfolio by open balances, business line, or geographies, then graphically representing DSO, CEI, Aging Bucket Performance etc. In this way, you can zero in on those segments that need extra attention.

Celebrate successes as a group, but also an action plan as a department to make sure that all stakeholders are vested in improvement or change initiatives.

Clarify Departmental Responsibilities and Focus Resources

Including a section in the policy that spells out the specific roles and responsibilities of the credit and collections staff is important. This helps streamline operations, prevent redundancy, and improve productivity. Each position listed should contain a job description. To enhance clarity, provide an organizational chart detailing reporting channels.

Credit and Collection Departments are generally composed of:

- Corporate Credit Manager

- Regional Credit Manager

- Collection Specialist

- Credit Analyst

- Credit Investigator

- Clerk

Establish a Credit Evaluation Process

The process of assessing credit risk and determining credit limits is critical to receivable management and should be detailed in the credit and collections policy. Indeed, the sum total of a company’s credit risk is the total of assigned credit limits, not the total of what is used from each line.

3 Basic Ratios for Credit Evaluation

- Quick Ratio: (Cash + AR + Cash Equivalents) ÷ Current Liabilities

- Degree of Leverage Ratio: Total Liabilities ÷ Net Worth

- Profitability Ratios: Set of measurements designed to determine a company’s ability to create earnings

- Contribution Margin Ratio: (Sales – Variable expenses) ÷ Sales

- Gross Profit Ratio: (Sales – (Direct materials + Direct Labor + Overhead)) ÷ Sales

- Net Profit Ratio: (Net profit ÷ Net sales) × 100

Other important ratios used in the credit evaluation process include:

- Times Interest Earned Ratio: Earnings before tax ÷ interest expense

- Collection Period Ratio (days): (Accounts receivable × 365) ÷ Net sales

- DSO Ratio: Accounts receivable ÷ Average sales per day

To make these decisions, organizations will typically leverage:

- Industry credit groups

- Credit bureau reports, D&B, Experian, The Risk Management Association (formerly Robert Morris Associates)

- Financial statements

- Credit references

- Public records

- Other information obtained directly from the applicants

It’s good practice to schedule all or a portion of your accounts for routine review.

Financial Statement: Shortcomings

- Time: Financial statements show position on a specific date., and statements that are “current” at times may be 2-14 months old. If the numbers show a weak financial condition at the balance sheet date, it’s best to get bank and trade references.

- Determination of Trends: One year’s financial statements is not enough.

- Audited/Unaudited Statements: Audited are best, though you will likely receive unaudited statements.

Establishing regular credit evaluation as part of your policy will allow you to monitor any changes in the risk level of your receivable portfolio. You can then adjust credit and collection policy accordingly. Specifically, if the portfolio is becoming a little more precarious than your appetite for risk permits, constrict your credit policy and tighten your collection plan. Use your option to revise limits based on changing levels of creditworthiness.

Systematize Collection Procedures

Handling the aged portion of your organization’s accounts receivable portfolio requires planned action that reflects the mission and goals of the credit department. Clearly written policy on important collection procedures will ensure consistent and effective A/R management that contributes to realizing those goals. The section should include:

- When to contact a customer

- How to contact a customer

- When to place an account on credit hold

- How to resolve disputes, deductions, etc.

- When to turn over delinquent accounts to an outside collection agency

- When to write an account off to bad debt

Establish Terms of Sale

Including the terms of sale in the credit policy sets up guidelines that allow for quick, consistent decision making at the time of sale, and in determining when the account falls due.

While terms may vary among a company’s product lines, having a written policy dealing with terms of sale issues is essential. Any exception to the established terms must be based on competitive practices and generate a satisfactory return on investment.

Keep the Momentum – Keep It Relevant

A credit and collection policy creates a structured environment that can safeguard your organization’s most precious asset – accounts receivable. Formulating such a policy, however, is not a one-time effort. In order for it to maintain its relevance and continue to have a positive impact on cash flow and revenues, it must be routinely updated in response to the changing economy, market conditions, and competitive environment.

If you enjoyed this article, check out these other credit management articles.

For more information about our credit and commercial collection agency, contact us at 844.937.3268 today!