Location and Size

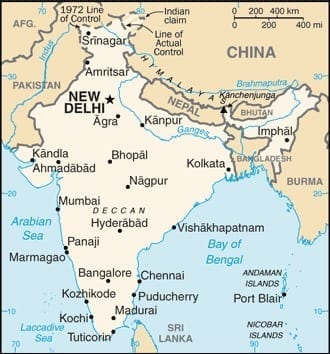

India is located in Southern Asia, bordering the Arabian Sea and the Bay of Bengal, between Burma and Pakistan. Its total area is 3,287,263 sq km, slightly more than one-third the size of the U.S., making it the 7th largest country in the world.

Government

India is the world’s largest democracy. It is considered a Federal Republic and is made up of 29 states and 7 union territories. Below are the branches of government

Executive:

- Chief of State: President Ram Nath KOVIND; Vice President M. Venkiaiah NAIDU

- Head of Government: Prime Minister Nerendra MODI

- Cabinet: Appointed by the president on the recommendation of the prime minister

Legislative: Bicameral Parliament consisting of the Council of States and the People’s Assembly

Judicial: Supreme Court (one chief justice and 32 associate justices are appointed by the president and remain in office until they reach the age of 65 or are removed for “proved misbehavior”)

Legal System

India’s legal system is based on English common law. The judiciary reviews legislative acts and there are separate personal law codes that apply to Christians, Hindus and Muslims. The Indian judicial system is divided into District Courts, High Courts and Supreme Court.

India has accepted compulsory International Court of Justice (ICJ) jurisdiction with reservations.

Interesting Facts About India

- Second fastest growing economy in Asia, after China

- One of only three countries that builds its own supercomputers

- Fourth largest economy in the world (measured in purchasing power parity)

- One of just six countries that launches its own satellites

- 100 of the Fortune 500 have R&D facilities in India

- Second largest group of software developers in the world, after the U.S.

- World’s largest producer of milk; second largest producer of food, including fruits and vegetables

- World’s second largest pharmaceutical industry, after China

Economy

The economy slowed in 2017, due to shocks of “demonetization” in 2016 and introduction of GST in 2017. Since the 2019 election, the government has passed an important goods and services tax bill and raised foreign direct investment caps in some sectors, but most economic reforms have focused on administrative and governance changes, largely because the ruling party remains a minority in India’s upper house of Parliament, which must approve most bills.

India has a young population, in which 50% of the working population is under 25 years of age. It has a corresponding low dependency ratio, healthy savings and investment rates, and is increasing integration into the global economy. It is currently the fastest growing economy in the world, ranking 7th in the world for GDP. However, long-term challenges remain significant, including: India’s discrimination against women and girls, an inefficient power generation and distribution system, ineffective enforcement of intellectual property rights, decades-long civil litigation dockets, inadequate transport and agricultural infrastructure, limited non-agricultural employment opportunities, high spending and poorly targeted subsidies, inadequate availability of quality basic and higher education, and accommodating rural-to-urban migration.

Leading Markets (2020): US 17%, UAE 9%, China 5%

Leading Exports – Commodities: Refined petroleum, diamonds, packaged medicines, jewelry, cars

Leading Suppliers (2020): China 15%, US 7%, UAE 6%, Saudi Arabia 5%

Leading Imports – Commodities: Crude petroleum, gold, coal, diamonds, natural gas

Top Industries: Textiles, chemicals, food processing, steel, transportation equipment, cement, mining, petroleum, machinery, software, pharmaceuticals

Top Agricultural Products: Sugar cane, rice, wheat, buffalo milk, milk, potatoes, vegetables, bananas, maize, mangoes/guavas

Comparative Economic Indicators – 2021

| India | Pakistan | Bangladesh | Sri Lanka | China | USA | |

|

Population

(USD millions)

|

1,339.33 | 238.18 | 164.09 | 23,04 | 1,397.89 | 334.9 |

| Population growth rate (%) | 1.04 | 1.99 | 0.95 | 0.63 | 0.26 | 0.7 |

| Literacy (%) | 74.4 | 58 | 74.9 | 92.3 | 96.8 | 99.0 |

| Unemployment rate (%) | 7.9 | 6.9 | 4.2 | 4.8 | 4.2 | 4.6 |

| Inflation (%) | 3.7 | 9.3 | 5.5 | 4.3 | 2.8 | 5.4 |

| Population below poverty line (%) | 9.7 | 5.4 | 18.1 | 4.1 | 0.6 | 13.4 |

| GDP (USD billions) | 2,835.9 | 1,021.1 | 793.49 | 274.8 | 23,009.8 | 19,846.7 |

| GDP real growth rate (%) | 4.86 | 5.40 | 7.40 | 2.29 | 6.14 | 2.16 |

| GDP per capita*** (USD) | 6,100 | 4,600 | 4,800 | 12,500 | 16,400 | 60,200 |

| Public debt* (% of GDP) | 71.2 | 67.0 | 33.1 | 79.1 | 47.0 | 78.8 |

| Exports (USD billions) | 484.95 | 27.30 | 38.78 | 19.41 | 2,732.4 | 2,127.2 |

| Imports (USD billions) | 493.18 | 51.07 | 57.26 | 24.56 | 2,362.7 | 2,808.9 |

| Currency | Rupee INR |

Rupee PKR |

Taka BDT |

Rupee LKR |

Yuan Renminbi CNY |

Dollar USD |

| Exchange rates (per USD 11/19/2021) | 0.013 | 0.0057 | 0.012 | 0.005 | 0.16 | N/A |

| Exchange rates per (EUR 11/19/2021) | 0.012 | 0.0051 | 0.010 | 0.004 | 0.14 | 0.89 |

Data from CIA World Factbook

***PPP – Purchasing Power Parity

Credit and Collections

India’s legal system is complex and procedures are time consuming. Corruption is always a factor that creditors have to take into account. That said, the third-party debt collection industry plays an important role in the Indian economy. The industry recovers billions of dollars in delinquent debt each year.

Due to the increasingly developed banking network in India, SWIFT bank transfers are becoming more popular for both international and domestic transactions. Standby Letters of Credit constitute a reliable means of payment, as a bank guarantees the debtor’s credit quality and repayment abilities. Confirmed Documentary Letters of Credit are also recognized, although these can be more expensive, as the debtor guarantees that a certain amount of money is available to the beneficiary via a bank. Post-dated checks, a valid method of payment, also act as a debt recognition title. They allow for the initiation of legal and insolvency proceedings in cases of outstanding payments.

Contractual Interest: The Indian legal system allows for contractual interest up to 14% on a case-by-case basis. In litigation cases, however, the amount of interest awarded is left to the discretion of the court.

Statute of Limitations: Three years from the due date, or clear acknowledgement, for commercial invoices as well as for bills of exchange and promissory notes.

Dispute Resolution

According to the World Bank, India is the 6th slowest country in the world in the number of days it takes to resolve a dispute.

It takes about seven years to liquidate a business in India. Foreign awards are enforceable under multilateral conventions such as the Geneva Convention. The International Center for Alternative Dispute Resolution (ICADR) has been established as an autonomous organization under the Ministry of Law, Justice, and Company Affairs to promote settlement of domestic and international disputes through alternative dispute resolution.

Summary Action: The objective underlying the summary procedure is the prevention of unreasonable obstructions by a defendant who has no defense. A summary action can be initiated, if the creditor has bills of exchange or promissory notes. The debtor is not automatically entitled to defend the suit, but must ask the court permission to defend. Permission to defend is only granted if the affidavit filed by the debtor discloses facts deemed by the court as sufficient for granting such permission. The expected time frame for a Summary Action is one year. Enforcement of judgments is carried out on all movable or immovable assets, provided they have been identified, located previously, and they are free of encumbrances.

Ordinary Suit: An extremely time-consuming procedure in which the creditor faces obstacles like remedies, adjournments, and corruption. It is not advisable to start legal actions if the creditor does not have a strong case with unequivocal documents and evidence. A less time consuming route would be to move forward with a National Company Law Tribunal (NCLT) proceeding. The NCLT is a quasi-judicial body that that adjudicates issues relating to Indian companies.

Another option is for the creditor to try obtaining an out of Court settlement, as ordinary actions often conclude with no concrete results. When documents are submitted, the creditor will be required to be present for cross-examination before the Court determines whether the documents are admissible.

Insolvency Proceedings

International commercial arbitration in India has several steps and processes, and is used around the globe for resolving international business debts. It’s relatively easy to force awards under the New York Convention and Geneva Convention legal standards, and has been ratified by 158 countries. Arbitration can take place in a neutral location, such as New York, London or Singapore, and award holders have to present an authentic copy of the award if there is a reciprocal treaty.

The key principles of international commercial arbitration are as follows:

- Arbitration clause in agreement while doing cross border transactions;

- Arbitral award may be recognized and enforced as a final judgement in each contracting company, subject to certain narrow exceptions.

The grounds for not recognizing an arbitral award occurs when:

- the arbitration agreement was invalid;

- the losing party was not properly notified of the arbitral proceedings;

- the award “deals with a difference not contemplated by or not falling within the terms of the submission to arbitration, or it contains decisions on matters beyond the scope of the submission to arbitration;”

- the tribunal composition was improper;

- the award “has been set aside or suspended by a competent authority of the country in which, or under the law of which, that award was made;” or

- the “subject matter” of the dispute is not “capable of settlement by arbitration” under that country’s law.

Risk Assessment

Inflation is likely to decrease and meet the Reserve Bank of India’s (RBI) 2‐6% target range, after peaking in 2020 due to disorganized supply chains, floods in eastern India, domestic taxes on petroleum products and a surge in gold prices.

Coface Country Rating: C — The economy is set to rebound gradually in 2021, but pre‐existing headwinds might impede the growth momentum. Private consumption (57.9% of GDP) is likely to recover slowly due to a weak outlook, as income loss and the increase in unemployment induced by the lockdowns are unlikely to be fully absorbed.

Coface Business Climate Rating: B — A somewhat shaky political and economic outlook and a relatively volatile business environment can affect corporate payment behavior. Corporate default probability is still acceptable on average.

Credendo Political Risk: 2.75 (Low based on a scale of 1-lowest risk to 10-highest risk)

Credendo Business Environment Risk: E (Above average risk based on A-low risk to G-high risk)

Business Climate

Thanks to its vast pool of highly skilled labor and the stable political climate, India is one of the most attractive investment places in the world. It has liberalized the economy during the last 25 years and the government has a business-friendly policy.

The Indian market, with its 1.3+ billion population, presents lucrative and diverse opportunities for exporters with the right products, services, and commitment. India requires equipment and services for major sectors such as energy, environmental, healthcare, high-tech, infrastructure, transportation, and defense. This need will exceed tens of billions of dollars in the mid-term as the Indian economy further globalizes and expands.

Intellectual Property Rights: India has generally adequate copyright laws, but enforcement is weak and piracy of copyrighted materials is widespread. Trademark protection is good and meets international standards. However, Indian law provides no protection for trade secrets.

Right to Private Ownership (by foreign companies): Subject to certain sector-specific restrictions, foreign and domestic private entities may establish and own businesses in trading companies, subsidiaries, joint ventures, branch offices, project offices and liaison offices. The Government of India does not permit investment in real estate by foreign investors, except for company property used to do business and for the development of most types of new commercial and residential properties.

Economic Freedom: India’s economic freedom score is 56.5, making its economy the 121st freest in The Heritage Foundation’s 2021 Index of Economic Freedom. Its score is unchanged from 2021. India is ranked 26th out of 40 countries in the Asia-Pacific region, and its overall score in below the regional and world averages.

Corruption: According to the GAN’s Risk & Compliance Portal: “Companies operating or planning to invest in India face high corruption risks. Despite that the government has stepped up its efforts to counter corruption, red tape and bribery continue to be widespread. Corruption is especially prevalent in the judiciary, police, public services, and public procurement sectors. Due to varying levels of corruption and quality of government operations across India, local investment conditions vary between and within states.”

Transparency International, in its 2020 Corruption Perceptions Index, ranked India 86th out of 180 countries, giving it a score of 40 out of 100.

For more detailed information on these topics, visit the 2021 Investment Climate Statement – India, of the U.S. Department of State.

Business Protocol in India

In general, Indians prefer to do business with people they know, as relations are built on mutual trust and respect.

There are numerous official (recognized by the central government) and unofficial Indian languages. Hindi is the “official” language and is the most widely spoken (41% of the population). However, English has the status of “subsidiary official” language. Most commercial communication (within India and with other countries) is done in English.

Sources for further information on doing business in India

American Chamber of Commerce in India

Doing Business in India, The World Bank

Embassy of India, Washington, DC

Embassy of the United States, India

Indo-American Chamber of Commerce

**********

Subscribe to the Credit-to-Cash Advisor

Monthly e-Newsletter — It’s Free

This information is provided by ABC-Amega Inc. Providing international receivable management and debt collection services for exporters to more than 150 countries including India. For further information, contact [email protected].

This report represents a compilation of information from a wide variety of reputable sources.

Comparative Economic Indicators: CIA World Factbook

Risk Assessment information: Coface Country Rating and Credendo.

Exchange Rates: OANDA.com The Currency Site.

Other information is provided by sites including FITA.