There are several ways to calculate DSO. And, when used appropriately and consistently, these calculations can help answer a variety of questions about the effectiveness of your credit and collection policies and practices. Questions like, are your credit terms in line with competitors? Are your collection procedures successful in meeting stated goals? Is your customer base risky?

Before discussing the various DSO formulas, below are six requirements that make DSO, or any performance measure, more meaningful.

- The measure should express a value that complements and supports the objectives of your company and department.

- It must be communicated to all individuals responsible for the collection process being measured.

- It must be compared to some standard, for instance, past company performance, or an industry benchmark.

- It must be used consistently, from month to month, year to year.

- The results should elicit some action – correcting course, managing change for improvement.

- It should provide a benefit. This could be as basic as the satisfaction of reaching a goal that contributes to the organization’s success.

Formulas for Calculating DSO

DSO is important as a financial indicator to the extent that it shows the average amount of time it takes for a company to turn its receivables into cash.

It can give insight into the changes occurring within an organization’s accounts receivable balance. It does so by indicating whether a change occurred because of a positive or negative fluctuation in sales during that period, or if other business factors, such as promotional discounts, seasonality, selling terms, etc., created the effect.

Each method for calculating DSO (outlined below) is based on what might be called the Standard DSO Formula, and each has its own strengths. The key to making effective use of any of these tools is consistency. Select the methods that work best for you and stick with them.

For each of the example DSO calculations that follow, we will use the same receivables data, given below. The date of the calculation is October 1, 2019.

| Date of Invoice |

Age Bucket | Dollars in Bucket |

Credit Sales in Period |

| 9/28/19 | Current | $3,000 | $5,000 |

| 8/28/19 | 1-30 days past due | $3,000 | $6,000 |

| 7/28/19 | 31-60 days past due | $2,000 | $5,000 |

| Total Open Receivables | $8,000 | $16,000 |

Sales Periods (for consistency):

- Annual = 365 days

- Six Months = 182 days

- Quarter = 91 days

- Month = actual # days in the month

Note that since the data utilized is limited and quite simple, the various DSO calculations should be close to equal.

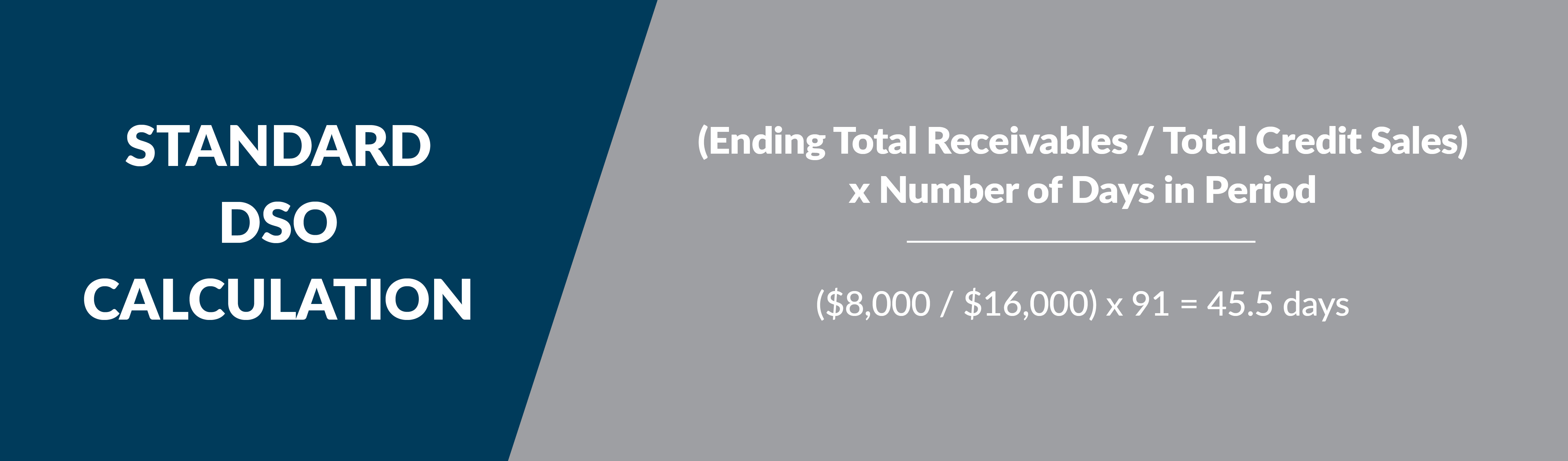

Standard DSO Calculation

The Standard DSO calculation provides an average (aggregate) time in days it takes to convert accounts receivables into cash. It should be tracked over time and compared to previous company results or industry/competitor benchmarks.

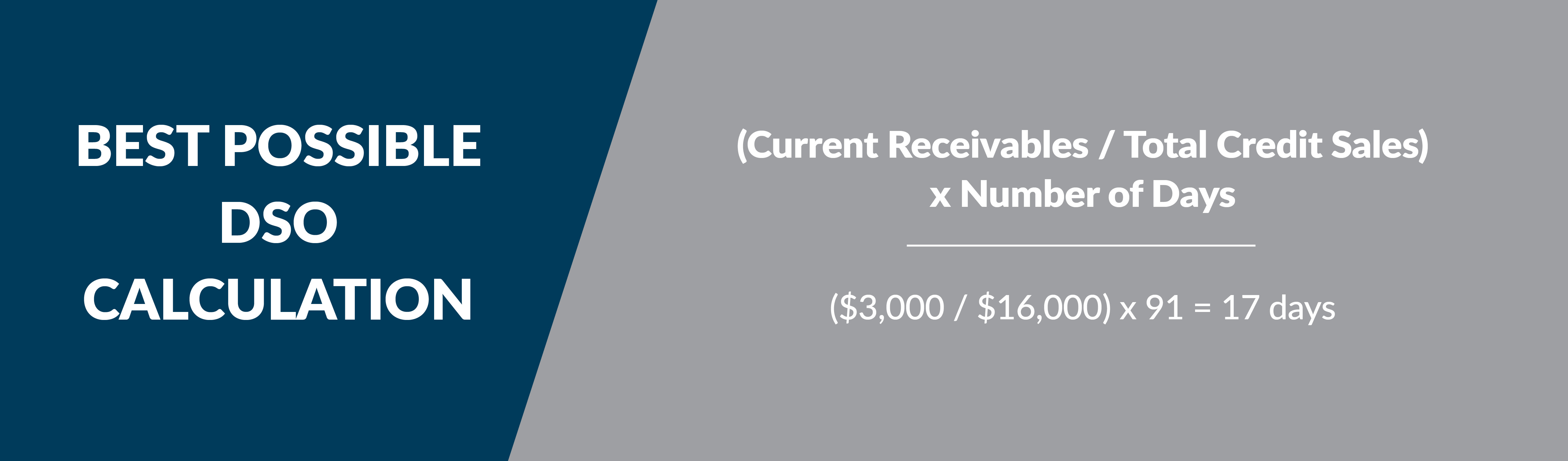

Best Possible DSO Calculation

Best Possible DSO utilizes only your current (non delinquent) receivables to calculate the best length of time you can achieve in turning over receivables. It should be compared to the standard calculation above, and be close to your terms of sale.

The closer your standard DSO is to your best possible DSO, the closer your receivables are to your optimal level.

Delinquent DSO (Average Days Delinquent) Calculation

Delinquent DSO or Average Days Delinquent (ADD) calculates the average days invoices are past due. This provides a snapshot to evaluate individuals, subgroups or overall collection performance.

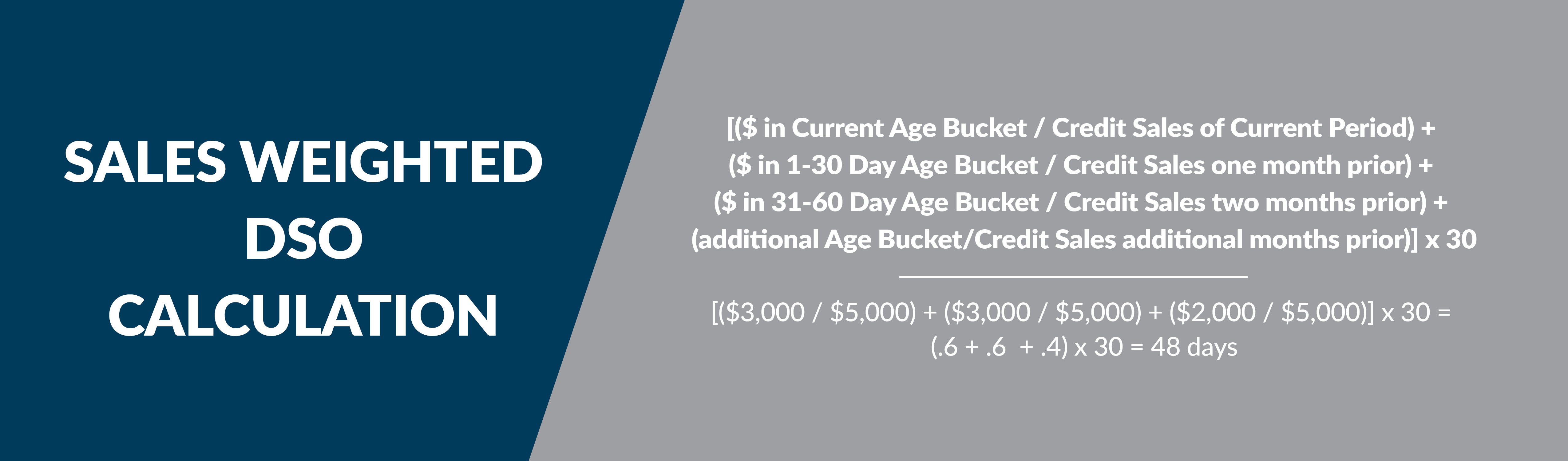

Sales Weighted DSO Calculation

Sales Weighted DSO, as with the regular DSO calculation, measures the average time that receivables are outstanding. However, some consider it an improvement over other methods of calculating DSO because it attempts to smooth out the bias of credit sales and terms of sale.

Sales Weighted DSO Formula:

Countback DSO Calculation

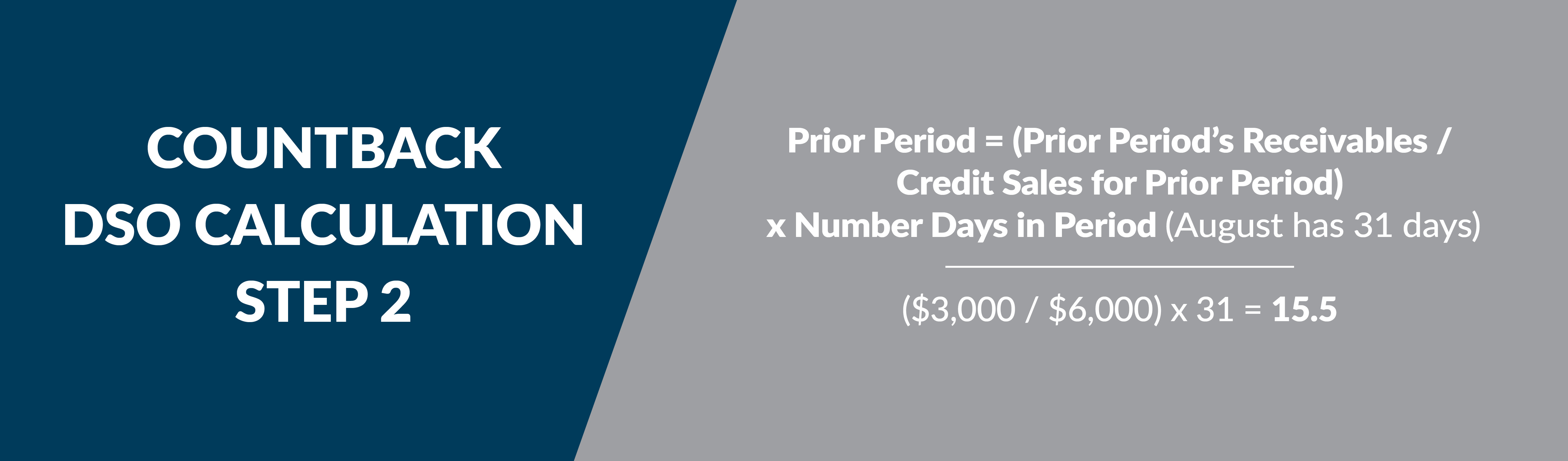

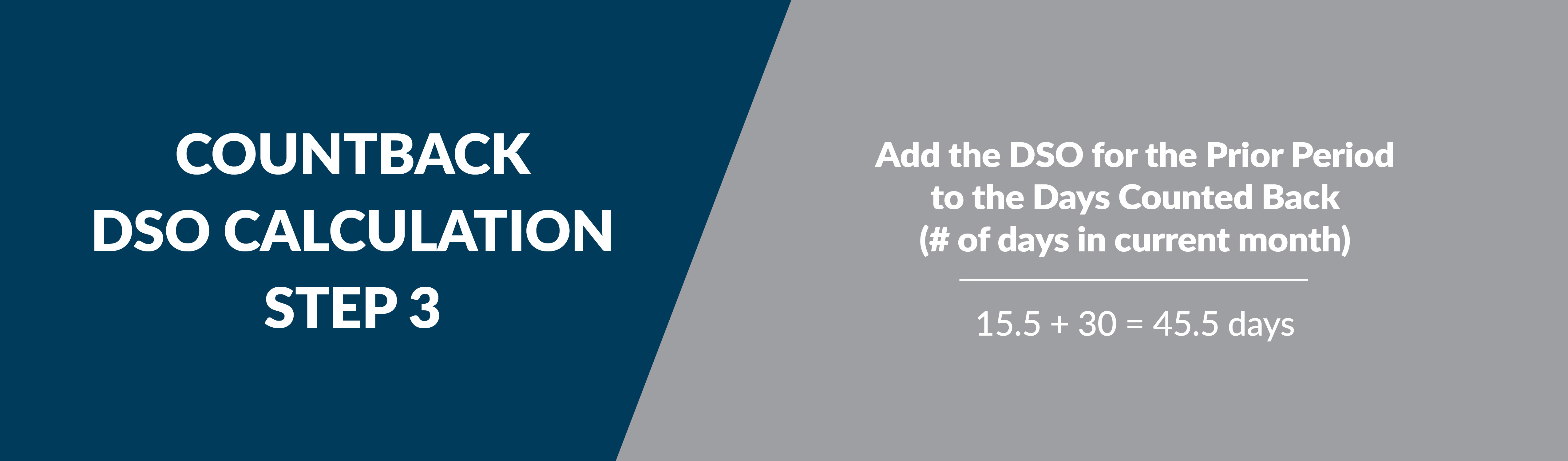

The Countback Method of calculating takes into account sales fluctuations.

This method provides a more accurate picture of DSO and its month-to-month fluctuations in sales and past due receivables.

Giving more weight to the current month’s sales, it reflects the correct assumption that most of the accounts receivable balance will be from current, as opposed to previous sales. It also takes into account the real effect of the actual difference in the number of days per month (i.e. 28 in February vs. 30 in April, June, September, November vs. 31 the rest of the months).

The Countback Method can be used with any time frame. If terms are net 30, then monthly balances are used. If terms are net 10, weekly numbers might be used. This method involves three steps.

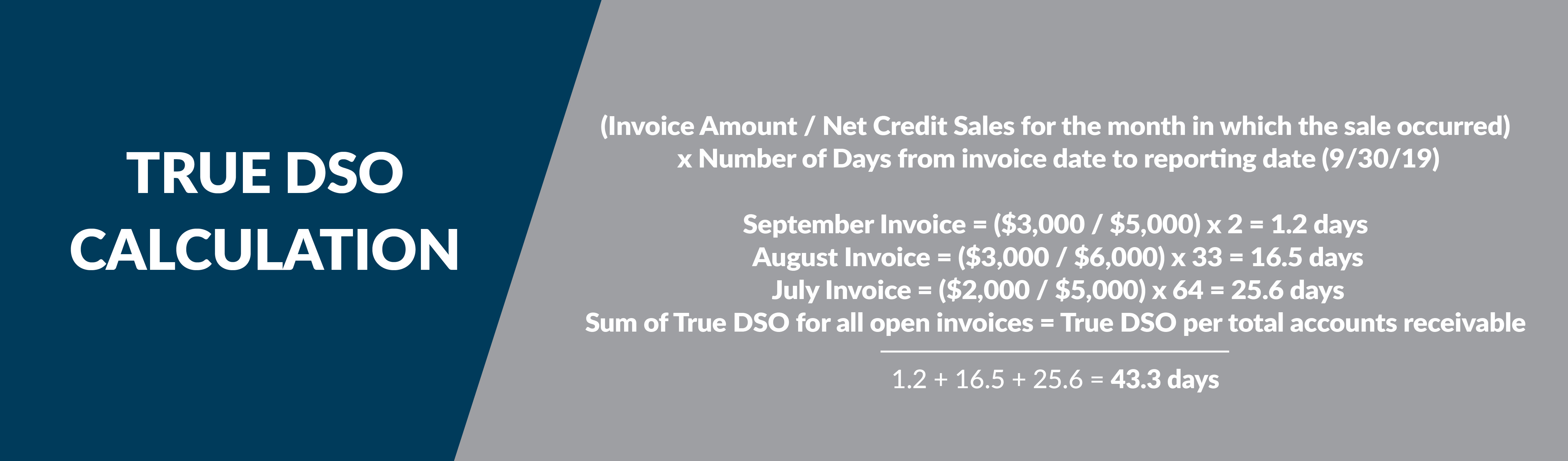

True DSO calculates the actual number of days credit sales are unpaid by tracking individual invoices to the month of sale.

Benchmarking DSO

In general, if your company’s DSO is no more than 10-15 days longer than the terms of sale, the receivables are turning into cash without much difficulty. Benchmarking data for DSO is somewhat hard to come by, and even more difficult to find without paying a fee.

The Credit Research Foundation (CRF) does a quarterly study, the National Summary of Domestic Trade Receivables (a.k.a., the DSO Survey), that is an examination of the condition of A/R for U.S. companies. The CRF has been collecting this data quarterly since 1960.

The results of the complete study are available to CRF members and those participating in the survey.

The CRF website also has a great tool for visualizing DSO, the Quarterly National Summary of Domestic Trade Receivables Calculator.

Another source of benchmarking information can be gained from joining an industry credit group. Some credit groups perform quarterly DSO surveys based on data provided by the group members. If you are not already a member of a credit group, you should seriously consider becoming one.

Learn more from ABC-Amega about the benefits of credit group membership.

*******

Check out these other credit management articles on our website.