Most sellers are very familiar with Open Account (O/A) and Letter of Credit (L/C) transactions. In the international arena, open account sales are regarded as having the most risk; letter of credit transactions as having the least.

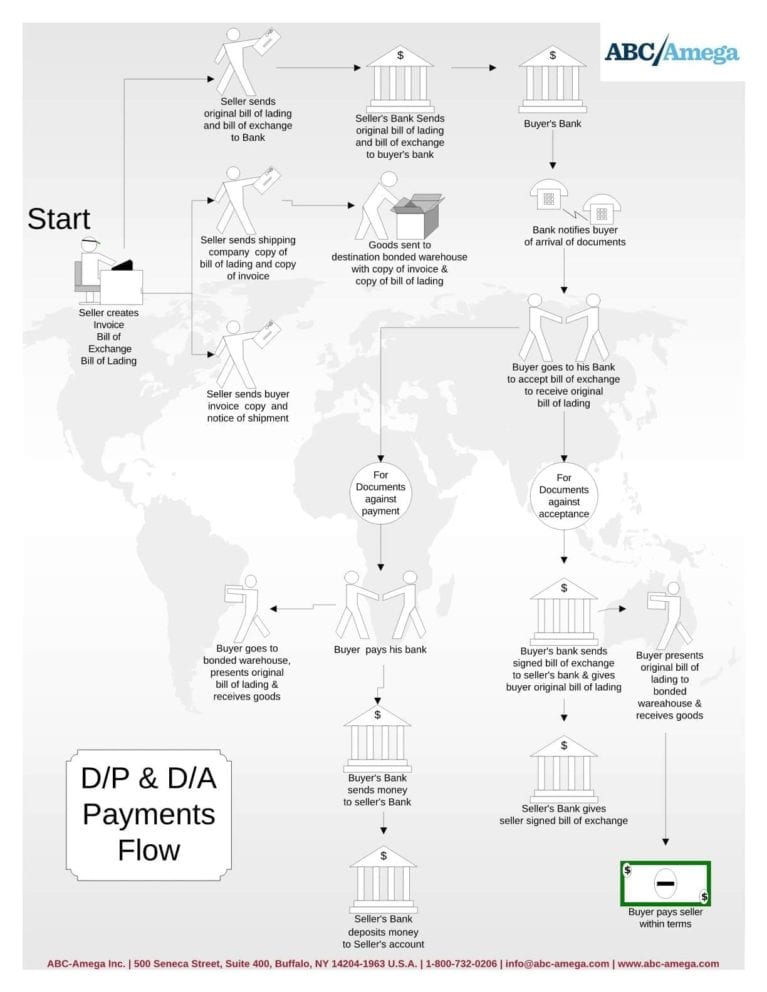

Between these two poles, however, are two lesser-known transaction types: Documents Against Payment (D/P) and Documents Against Acceptance (D/A). These represent risk levels lower than an O/A, but greater than an L/C. Both rely on an instrument widely used in international trade called a bill of exchange or draft.

Bill of Exchange / Draft

A bill of exchange, or draft, is a negotiable instrument that is both drawn up by and made payable to the exporter/seller. Although written by the seller, it has the equivalent effect of a check written by the buyer.

It is generally a three-party instrument consisting of a:

- Drawer: The party issuing the bill of exchange; usually the exporter/seller.

- Drawee: The recipient of the bill of exchange for payment or acceptance; usually the buyer.

- Payee: The party to whom the bill is payable; usually the seller’s bank.

Bills of exchange are either payable at sight (sight drafts) where the bank pays the full amount upon presentation, or payable at some future date (time or term drafts).

D/P – Documents Against Payment

The D/P transaction utilizes a sight draft, where payment is on demand.

After the goods are shipped, the exporter sends the sight draft to the clearing bank, along with documents necessary for the importer/buyer to obtain the goods from customs. The buyer has to settle the payment with the bank before the documents are released and he can take delivery of the goods. If the buyer fails or refuses to pay, the exporter has the right to recover the goods and resell them.

On the surface, D/P transactions seem fairly safe from the seller’s perspective. However, in practice, there are risks involved:

- The buyer can refuse to honor payment on any grounds.

- When the goods are shipped long distances, say from Hong Kong to the United States, it is usually impractical and too expensive for the seller to pay for return transportation. Thus, the seller is forced to sell the goods in the original country of destination at what is usually a heavy discount.

- Unlike letters of credit, the exporter’s bank does not assume liability to pay if the importer dishonors the Bill of Exchange.

- In cases of shipments by air freight, it is possible that the buyer will actually receive the goods before going to the bank and paying for them.

D/A – Documents Against Acceptance

The D/A transaction utilizes a term or time draft. In this case, the documents required to take possession of the goods are released by the clearing bank only after the buyer accepts a time draft drawn upon him. In essence, this is a deferred payment or credit arrangement. The buyer’s assent is referred to as a trade acceptance.

D/A terms are usually after sight, for instance “at 90 days sight”, or after a specific date, such as “at 150 days bill of lading date.”

As with open account terms, there are some inherent risks in selling on D/A:

- As with a D/P, the importer can refuse to accept the goods for any reason, even if they are in good condition.

- There is a slight risk that the importer will receive their goods without the original shipping documents (such as a bill of landing, commercial invoice, or certificate of origin).

- The buyer can default on the payment of a trade acceptance. Unless it has been guaranteed by the clearing bank, the seller will need to institute collection procedures and/or legal action.

Avalisation of the Bills of Exchange

In certain cases, exporters may seek out a third party—typically a bank—to guarantee payment of a bill of exchange drawn on the importer. The process of a third party endorsing the back of a bill of exchange is called Avalisation, and can be utilized at the exporter’s request in situations where risk is high. In doing so, the exporter has shifted potential risk onto the bank if an importer does not accept or does not pay a bill of exchange.

Discounting a Bill of Exchange

If the drawer of a bill does not want to wait for the drawee to send funds, the drawer can sell the Bill of Exchange to a bank at a discounted rate. This should only be considered when the risk involved in D/P or D/A transactions still proves financially burdensome after considering avalizing the bill. The process for discounting is as follows:

- The bill first must be endorsed by the drawer with a signed and dated order to pay the bank.

- The bank then becomes the holder (owner) of the bill.

- Once ownership transfers, the bank pays the original drawer of the bill an agreed upon rate.

- Payment is equal to face value of the bill unless interest accrues. (Face value = amount issuer provides bond holder when bill reaches maturity)

Advantages for the Seller in D/P and D/A Transactions

Despite the risks listed above, utilizing D/P and D/A transactions have a number of advantages for the seller:

- The bill of exchange facilitates the granting of trade credit to a buyer.

- It can provide the seller access to financing.

- The bill of exchange is formal, documentary evidence, acceptable in most courts, confirming that the demand for payment (or acceptance) has been made to the buyer.

- The seller retains control over the goods until the buyer either pays draft on sight (D/P) or as a legal time & terms draft (D/A).

- Bills of exchange can be bought and sold at a reduced rate through discounting.

Recourse for Dishonored Bills of Exchange

It is possible for the seller to dispute an unpaid/unaccepted (called dishonored) bill of exchange, sue the buyer, and potentially receive payment. Dishonor occurs when the drawee fails to pay on date of maturity or fails to accept the bill of exchange. The seller disputes a dishonored bill of exchange via a formal, usually two-step, process.

Step #1 Noting: A bill of exchange is noted in order to obtain official evidence that it has been dishonored. A Notary Public presents the bill/draft to the drawee (buyer) for acceptance or payment and notes on the bill the reason given for dishonor. Noting is often followed by a formal protest.

Step #2 Protesting: The Notary Public produces a formal deed of protest bearing his seal. This document provides formal evidence of the presentation of the bill to the drawee and the reason for the dishonor. The protest is accepted by most courts in the world as prima facie evidence that the bill has been dishonored.

Should the buyer fraudulently obtain possession of the documents, or the goods, without paying or accepting the bill of exchange, it is possible to seek satisfaction from the clearing bank or the customs warehouse. ABC-Amega made and won such a claim for a fireworks manufacturer in the People’s Republic of China. (Note: the names of the parties have been changed.)

Real-Life Case Study

The Parties

Exporter: China Fireworks Co., Anywhere, China

Importer: U.S. Fireworks Co., Anytown, USA

Clearing/Importer’s Bank: First Commercial Bank, New York USA

Terms of Sale: D/P (Documents Against Payment)

The Issue

China Fireworks Co. sold a container load of fireworks to U.S. Fireworks on D/P terms.

The exporter prepared the paperwork for the transaction, including an original Bill of Lading (B/L), a Bill of Exchange (in this case, sight draft), and an original invoice. The Bill of Exchange would be payable through the exporter’s bank and would be drawn on First Commercial Bank (the importer’s bank).

The exporter faxed a copy of the Bill of Lading and the invoice to the buyer with confirmation that the goods would be shipped via United Shipping on the freighter Morristown on May 16th. The fireworks were to arrive at the bonded warehouse in New York City on June 15th.

The goods were picked up from the exporter by United Shipping. United Shipping’s representative signed and stamped the original bill of lading and returned it to the China Fireworks representative, Mr. Zhang. Mr. Zhang then took the entire package of documents to this bank, where the Documentary Credit’s Clerk personally placed the necessary items, along with explicit instructions on the terms of the transaction, into a courier package. The package was sent to First Commercial Bank in the USA.

On June 22nd, a week after the shipment was to have arrived in New York City, China Fireworks contacted their bank to determine if payment had been received. Payment had not been made and the Chinese bank wired First Commercial Bank inquiring about the transaction. Did the buyer accept the bill of exchange? Did the buyer receive the original bill of lading?

In the meantime, China Fireworks’ U.S. representative heard that U.S. Fireworks had indeed picked up the goods from the warehouse. In fact, they had already been used in a spectacular July 4th celebration on Coney Island.

On November 15th, a full five months after the goods arrived in the U.S., China Fireworks, which had still not received payment or any correspondence from the U.S. bank, placed the account with ABC-Amega for collection.

ABC-Amega’s collector immediately attempted contact with U.S. Fireworks. However, the phone number had been disconnected. Further research turned up the fact that U.S. Fireworks had filed Chapter 7 and was now out of business. The next call was to United Shipping’s warehouse in New York City, which did, in fact, have a bank-endorsed original bill of lading on file for the transaction. The next logical step was to contact First Commercial, the buyer’s bank.

After some research by the documentary collections clerk, ABC-Amega found that the bank’s file did still contain the bill of exchange, which had not been signed by the buyer. The clerk also informed the collector that the bank had foreclosed on the buyer’s account to recoup their security interest. Therefore, there would be no payment for the fireworks.

Recourse

Obviously, First Commercial Bank had not followed appropriate D/P procedures. It had given the buyer the original bill of lading, which was filed at the warehouse, without collecting payment for immediate remittance to China Fireworks. ABC-Amega’s affiliate attorney recommended suit against the bank for:

- Breach of fiduciary trust

- Negligence

- Actual damages of $1.2 million (the value of the goods)

Suit requirements (costs) were sent to China Fireworks along with instructions as to what else would be needed to mount their claim against the U.S. Bank. These included:

- A notarized and legalized affidavit from Mr. Zhang of China Fireworks attesting to the documents he prepared.

- A notarized and legalized affidavit from the Documentary Credits Clerk of the Chinese bank, attesting to the instructions he prepared for First Commercial Bank, as well as the fact that he personally placed those items in a courier envelope sent to First Commercial Bank in New York City. (The collector had already received copies of the air bill and proof of delivery for the envelope.)

- Assurance from both China Fireworks and the Chinese bank that the two gentleman involved would, if necessary, appear as witnesses at trial.

The Results

First Commercial Bank, not surprisingly, mounted strong opposition to the case. Ultimately, it went to trial, the two Chinese gentlemen had to fly to the U.S. to testify, testimony of expert witnesses on both sides was taken, and considerable money was expended on both sides.

At the conclusion, the court granted Judgment to China Fireworks:

- $1.2 million actual damages (cost of the fireworks)

- $4.8 million punitive damages

- $10,000 interest

- $550,000 attorney’s fees

- $2,200 costs

Needless to say, China Fireworks was pleased with the outcome.

Conclusion

When documented fully and correctly, D/A and D/P transactions provide a means for exporters to extend some level of credit facilities to their customers, while at the same time protecting their legal rights to payment. For many international export agencies, it is the perfect median between expensive, time consuming letters of credit and the high-risks involved with handling open accounts.

Addendum: Rules Governing Bills of Exchange

Most countries have adopted codified laws on Bills of Exchange following, in general, those set forth in the League of Nations’ Geneva Conventions (1930).

- The United Kingdom Bills of Exchange Act 1882 is the basis for rules governing Bills of Exchange in Ireland, U.K. and Commonwealth countries that were part of the British Empire.

- In the United States, Article 3 of the Uniform Commercial Code governs the issuance, transfer and enforcement of negotiable instruments including bills of exchange.

The United Nations Commission on International Trade Law (UNCITRAL) has designed a Convention to harmonize the various country laws. This Convention, called the United Nations Convention on International Bills of Exchange and International Promissory Notes, was adopted and opened for signature by the UN General Assembly in 1988. It has not yet received the 10 signatures required for ratification. This Convention only applies if the parties use a particular form of a negotiable instrument indicating that the instrument is subject to the UNCITRAL Convention.

Check out these other credit management articles on our website.

For more information about our commercial collection agency, contact us at 844.937.3268 today!