Official Name: Argentine Republic

Internet Domain: .ar

International Dialing Code: +54

Time Zone: UTC -0300

Location and Size

Argentina is located in southern South America, bordering the South Atlantic Ocean. It has an area of 2.8 million sq. km. (1.1 million sq. mi.), approximately the size of the United States east of the Mississippi River. It is the second largest country in South America, after Brazil. The seasons are the reverse of the ones in the Northern hemisphere: i.e. winter is in June, July and August.

Government

Argentina is a republic. Its constitution, as revised in 1994, mandates a separation of powers into executive, legislative, and judicial branches at the national and provincial level. Each province also has its own constitution, roughly mirroring the structure of the national constitution.

- Executive: Chief of State and Head of Government, President Mauricio MACRI (Since 10 December 2015); Vice President Gabriela MICHETTI (Since 10 December 2015); cabinet appointed by the president

- Legislative: Bicameral National Congress

- Judicial: Supreme Court. Supreme Court judges are appointed by the president with approval of the Senate. Currently, the Supreme Court has seven judges. In 2006, the Argentine Congress passed a bill to gradually reduce the number of Supreme Court judges to five.

Legal System

The Argentine legal system is a mixture of US and West European legal systems.

Argentina has not accepted compulsory International Court of Justice (ICJ) jurisdiction. (What does this mean?)

The protection of free competition and property rights is impeded by corruption within the judiciary and political pressure on judges.

People

Argentines are a fusion of diverse national and ethnic groups. Waves of immigrants from many European countries arrived in the late 19th and early 20th centuries. Syrian, Lebanese, and other Middle Eastern immigrants number about 500,000 to 600,000, mainly in urban areas.

Argentina’s population is overwhelmingly Catholic, but it also has the largest Jewish population in Latin America. In recent years, there has been a substantial influx of immigrants from neighboring countries, particularly Paraguay, Bolivia, and Peru. The indigenous population, estimated at 700,000, is concentrated in the provinces of the north, northwest, and south.

The country’s education level and human development indicators have been substantially above the Latin American average.

- Population: 44,694,198 (2018 estimate)

- Population growth rate: 0.89% (2018 estimate)

- Languages: Spanish (official), Italian, English, German, French. Although Argentina’s official language is Spanish, Argentine Spanish sometimes sounds more like Italian than the Spanish of Spain.

- Literacy: 99.1% (2016 estimate)

- Ethnic Make-up: White (mostly Spanish and Italian) and mestizo (mixed white and Amerindian ancestry) 97.2%, Amerindian 2.4%, African 0.4%

- Religions: Nominally Roman Catholic 92% (less than 20% practicing), Protestant 2%, Jewish 2%, other 4%

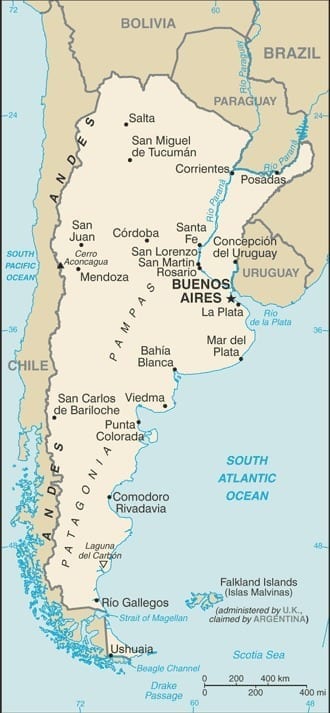

Map of Argentina

Economy

The Argentine economy has been steadily improving since it slid into recession in the late 1990s.

Argentina benefits from rich natural resources, a highly educated population, a globally competitive agricultural sector, and a diversified industrial base. Prior to 2008, the country had five consecutive years of over 8% real growth in domestic product (GDP). In 2008, the official real growth rate was 7.0%. GDP growth fell to an estimated -2.0% in 2009.

Currency: Argentine Peso (ARS)

Leading Markets (2018): Brazil 16.1%, US 7.9%, China 7.5%, Chile 4.4%

Leading Exports – Commodities: Soybeans and derivatives, petroleum and gas, vehicles, corn, wheat

Leading Suppliers (2018): Brazil 29.6%, China 18.5%, US 11.3%, Germany 4.9%

Leading Imports – Commodities: Machinery, motor vehicles, petroleum and natural gas, organic chemicals, plastics

Top Industries: Food processing, motor vehicles, consumer durables, textiles, chemicals and petrochemicals, printing, metallurgy, steel

Top Agricultural Products: Sunflower seeds, lemons, soybeans, grapes, corn, tobacco, peanuts, tea, wheat; livestock

Comparative Economic Indicators – 2018

| Argentina | Chile | Uruguay | Paraguay | Bolivia | Brazil | |

| Population (millions) | 44.69 | 17.92 | 3.36 | 7.02 | 11.30 | 208.84 |

| Population growth rate (%) | 0.89 | 0.75 | 0.27 | 1.17 | 1.48 | 0.71 |

| Literacy (%) | 98.1 | 97.5 | 98.5 | 93.9 | 95.7 | 92.6 |

| GDP** (USD billions) | 922.1 | 452.1 | 78.16 | 88.91 | 88.73 | 3,248.0 |

| GDP** per capita | 20,900 | 24,600 | 22,400 | 12,800 | 7,600 | 15,600 |

| Population below poverty line | 25.7 | 14.4 | 9.7 | 22.2 | 38.6 | 4.2 |

| Inflation (%) | 25.7 | 2.2 | 6.2 | 3.6 | 2.8 | 3.4 |

| Unemployment rate (%) | 8.4 | 6.7 | 7.6 | 5.7 | 4.0 | 12.8 |

| Exports (USD billions) | 58.45 | 69.23 | 11.41 | 11.73 | 7.74 | 217.2 |

| Imports (USD billions) | 63.97 | 61.31 | 8.61 | 11.35 | 8.60 | 153.2 |

| Foreign debt (% of GDP) | 57.6 | 23.6 | 65.7 | 19.5 | 49.0 | 84.0 |

|

Foreign exchange reserves

|

53.33 | 23.6 | 65.7 | 19.5 | 49.0 | 84.0 |

| Currency | Peso ARS |

Peso CLP |

Peso UYU |

Guarani PYG |

Boliviano BOB |

Real BRL |

| Exchange rates (per USD) on 07/18/2019 | 42.69 | 679.40 | 35.17 | 6,184.35 | 6.85 | 3.83 |

| Exchange rates (per EUR) on 07/18/2019 | 48.53 | 722.56 | 39.99 | 7,030.40 | 7.79 | 4.35 |

** PPP — Purchasing Power Parity

Credit and Collections

Dispute Resolution

The government of Argentina accepts the principle of international arbitration. Argentina is a party to the International Center for the Settlement of Investment Disputes (ICSID), the United Nations Commission on International Trade Law (UNCITRAL), and the World Bank’s Multilateral Investment Guarantee Agency (MIGA).

Bankruptcy Law

Argentina has a strict bankruptcy law similar to that of the United States. However, initiating bankruptcy proceedings is more difficult in Argentina.

Risk Assessment

Private company financial health has deteriorated in Argentina according to Coface, particularly in the automotive industry, construction, and distribution. The weakest sectors include agriculture and the dairy industry as a result of price controls and export problems, oil refining due to a lack of investment, and public services (water, electricity, gas, transport) because of regulated prices. Overall, the payment behavior of private companies, monitored by Coface, is expected to deteriorate.

Coface Country Rating: C — A very uncertain political and economic outlook and a business environment with many troublesome weaknesses can have a significant impact on corporate payment behavior. Corporate default probability is high.

Coface Business Climate Rating: B — The business environment is mediocre. The availability and reliability of corporate financial information varies widely. Debt collection can be difficult. Intercompany transactions run appreciable risks in the unstable, largely inefficient environments.

Credendo Political Risk Rating: 6 ” High risk (1-7)

Credendo Commercial Risk Rating: C ” Highest risk (A, B, C)

Business Climate

Nearly 500 U.S. companies are currently operating in Argentina, employing over 155,000 Argentine workers. The country benefits from rich natural resources, a highly educated population, a globally competitive agricultural sector, and a diversified industrial base. However, continuing Argentine arrears to international creditors and a large number of arbitration claims filed by foreign companies are legacies of Argentina’s 2001/2002 economic crisis that remain to be resolved.

Right to Private Ownership: Foreign and domestic investors have free and equal rights to establish and own businesses, or to acquire and dispose of interests in businesses without discrimination.

Market Access: Even though Argentina remains open to foreign investment and foreign companies can invest in the country on the same conditions as national companies, complicated and time-consuming regulations continue to pose an obstacle to doing business in Argentina.

Economic Freedom: According to the 2019 Index of Economic Freedom produced by The Heritage Foundation, Argentina’s economic freedom score is 52.2, making its economy the 148th freest in the 2019 Index. The country ranked 26th out of 32 countries in South and Central America and the Caribbean region. Its overall score is below regional and world averages.

Protection of Property Rights: Secured interests in property are recognized and common in Argentina. Such interests can be easily and effectively registered.

Conversion and Transfer Policies: Since 2001, the Argentine Ministry of Economy and the Central Bank have issued various new or revised foreign exchange transaction regulations in an attempt to normalize the foreign exchange market and to limit the peso’s appreciation against the dollar.

Intellectual Property Rights: The government of Argentina adheres to most treaties and international agreements on intellectual property and belongs to the World Intellectual Property Organization (WIPO) and the World Trade Organization (WTO). However, Argentina is on the Office of the U.S. Trade Representative’s intellectual property rights “Priority Watch List.”

Patents: Patent protection has been problematic in Argentina and extension of adequate patent protection to pharmaceuticals and genetically modified seeds has been a source of bilateral disagreement.

Corruption: Companies operating in Argentina are affected by both public and private sector corruption. Various legal measures have been enacted and institutions established to curb corruption. However, anti-corruption policies have not been at the forefront of the current president’s agenda.

Transparency International‘s Corruption Perceptions Index 2018 rates Argentina at 40 out of 100, ranking as the 85th most corrupt country out of 180 countries in the index.

Customs administration has been rife with corruption. While some observers suggest that this situation is changing, companies should note that others still consider the customs officials at border crossings to be coimeros, i.e. officials who receive bribes.

Political Violence: In 2005, around the time of the Summit of the Americas held in Argentina, there were approximately 20 incidents in which local groups were involved in small bombings, attempted bombings, or arson, mostly against U.S. businesses. Anti-U.S. pamphlets or graffiti were found at most of the 2005 incidents, none of which resulted in injury or death. Since these 2005 incidents, no other such events have occurred.

For more detailed information on these topics, visit the 2018 Investment Climate Statement ” Argentina, of the U.S. Department of State.

Business Protocol

Argentina is a relationship-driven culture, so it is important to build networks and use them. Name-dropping and nepotism do not have the negative connotations they have in the West and can be used to your advantage.

Business Cards: Have one side of your business card translated into Spanish. Present your business card so the Spanish side faces the recipient. In fact, have all printed material available in both English and Spanish.

Business Attire: Looking good in the eyes of others is important to Argentines. Therefore, you will be judged not only on what you say, but also on the way you present yourself. Men should wear dark colored, conservative business suits. Women should wear elegant business suits or dresses. Good quality accessories are important for both sexes.

Names and Titles: Address people by using the titles Señor [Mr], Señora [Mrs], Señorita [Miss] followed by surnames. When a woman marries, she adds her husband’s surname preceded by ‘de’ but keeps her father’s surname. Example: Julia Pérez marries Julio Larrea and becomes Julia Pérez de Larrea.

Appointments: Appointments are necessary and should be made 1 to 2 weeks in advance. It is necessary to obtain third party introductions through institutions such as law firms, consulting firms or banks. Punctuality is appreciated and expected from visitors to Argentina for all business related occasions. However, you may find your Argentine counterpart to be 15 to 20 minutes late.

Conversation: Argentines are well informed and proud of having the latest, most precise information. It is imperative to know what is going on in politics and sports for business negotiations.

Gifts: In a business context, choose gifts that will not be perceived as a form of bribery. The gift should be inexpensive but in good taste. Ensure the gift is properly wrapped and a card is enclosed.

Meetings: Argentines prefer face-to-face meetings. Once a relationship has developed, their loyalty will be to you rather than to the company you represent. It is imperative to show deference and respect to those in positions of authority. Decisions are not reached at meetings. Meetings are for discussion and to exchange ideas.

Negotiations: Business discussions should be preceded by some preliminary ‘small talk.’ Argentines expect to deal with people of similar status. Hierarchy is important. Decisions are made at the top of the company. Business moves slowly because it is extremely bureaucratic and decisions often require several layers of approval. Argentines have a difficult time disagreeing, so do not think that things are going well simply because no one is challenging what you say.

Articles of Interest on Argentina

Argentina’s economic crisis is the result of avoidable mistakes, The Guardian, September 10, 2019

Argentina imposes currency controls as its economic crisis deepens, CNBC, September 2, 2019

Explaining Argentina’s Financial Crisis: Macri, Cristina And The Specter Of Populism, Forbes, May 6, 2019

Sources for further information on doing business in Argentina

American Chamber of Commerce in Argentina

Argentine-American Chamber of Commerce Inc.

Doing Business in Argentina 2019, PriceWaterhouseCoopers (PDF)

Embassy of The Argentine Republic, Washington, DC

Embassy of The United States in Buenos Aires

**********

Subscribe to the Credit-to-Cash Advisor

Monthly e-Newsletter — It’s Free

This information is provided by ABC-Amega Inc. Providing international receivable management and debt collection services for exporters to more than 200 countries including Argentina. For further information, contact [email protected].

This report represents a compilation of information from a wide variety of reputable sources.

Economic Indicators: Variety of sources including the CIA World Factbook, Coface Country Rating, Federation of International Trade Associations (FITA) Country Profiles.

Risk Assessment information: Provided with permission by Coface Country Rating. Also Belgian credit insurance company Ducroire Delcredere

Historical Exchange Rates: OANDA.com The Currency Site.