Every business, big or small, will eventually have a collection issue. Despite your best efforts, some accounts will fall past due. Some customers simply will not pay. And, like a rusted bolt, they’re just not going to budge. So you reach out for a tool with added torque to get things moving – an outside collection agency (OCA).

The Commercial Collections Agencies of America (CCA of A) suggests the earlier a past due account is placed with a collection agency, the great the chances are for a full recovery. The recommendations of the Credit Research Foundation (CRF) say that “collection really starts with the customer invoice”. They recommend billing promptly, but to take a number of factors into consideration when it comes to collections. For additional information and examples, check out the following training course on CRF’s website: Principles and Practice of Commercial Collections. Both CCA of A and CRF also recognize the value of forwarding past due accounts to a reputable OCA for handling.

So, when it’s time to call in outside help, how do you select the right partner from among the thousands of collection agencies in the United States, let alone worldwide?

Choosing a reputable firm is important. But there’s much more than reputation to think about. You need a firm that fits your corporate culture and provides the kind of relationship you consider important. One that understands your expectations and will partner with you to help you meet your goals.

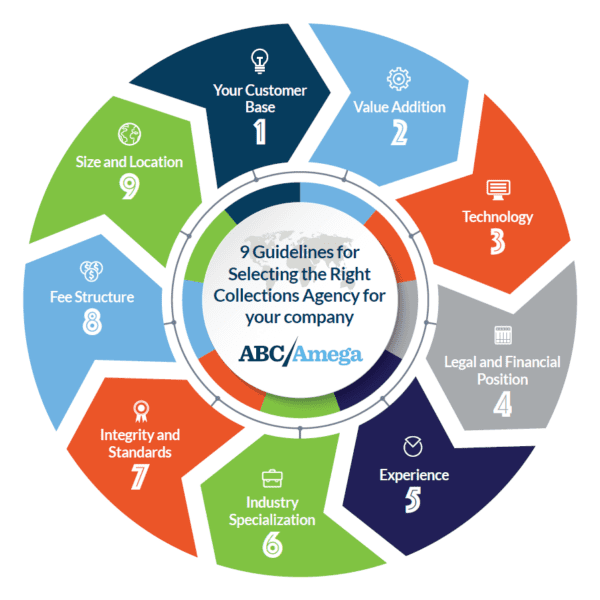

9 Guidelines For Selecting The Right Collections Agency For Your Company

Focusing on these nine areas will help you select the right collection agency for your company.

1. Your Customer Base

Are your customers, consumers, other businesses, or both? The agency you select should specialize in collecting from the category of customer you serve. A consumer agency for personal or consumer claims; a commercial agency for business-to-business (B2B) accounts. If you have a mixed portfolio, consider dividing it. This way you’ll be able to use the expertise of your collection partners most effectively. Another option is to find a company that has extensive experience in both consumer and commercial collections, or one with experience on your company’s industry.

2. Size and Location

Collection agencies range in size from small local agencies to large multinational firms. One size does not fit all. The size and reach of your OCA should match that of your company. If you’re a small business providing goods or services within your city or region, a small collection provider with good local contacts will be able to effectively handle your accounts. If, on the other hand, you sell nationwide or internationally, look for an agency with contacts and expertise across the U.S. and in the countries where you do business.

3. Integrity and Standards

If you hope to continue to do business with your customer once the bad debt is cleared up, you must select an agency that values integrity and conforms to high standards of customer relations. The way the OCA handles your customer during the collections process is a direct reflection on your business. An agency with a reputation for unethical collection practices and unprofessional treatment of customers quickly goes viral. Not only could they affect your future relationships with current customers, but they may also cost you prospective customers.

Here are some guidelines to ensure your collection agency will treat your customers professionally:

- If you need a commercial (business-to-business) agency, check to see if they are members of the Commercial Collection Agencies of America (CCA of A), International Association of Commercial Collectors (IACC), or the Commercial Law League of America (CLLA). These are the primary independent bodies regulating the commercial collection industry. Certification ensures that the agency adheres to a strict code of ethics and generally accepted accounting principles, and is bonded. Certification is reviewed on an annual basis.

- If you’re selecting a consumer agency, find out if they are members of the American Collectors Association. Confirm that they adhere to the rules of the Fair Debt Collection Practices Act, and the Fair Credit Reporting Act and that they are licensed and bonded in all 50 states.

- Call the Better Business Bureau where the agency is located. Check to make sure there haven’t been any complaints against the agency to which it hasn’t responded appropriately and attempted to resolve.

4. Legal and Financial Position

Size doesn’t necessarily mean strength. Smaller to mid-size agencies can be more financially stable than a large, public firm or a BPO. Try to determine if there are any negative financial issues that may affect the ability of the agency to pay you your money once it’s collected.

Check into their accounting practices. Do they maintain a separate account where monies from collections are held until remitted to you, the client? These are called “trust accounts,” and are required to obtain the agency certifications mentioned above.

Many states require collection agencies to be licensed in order to collect within those states. Practically every state requires consumer agencies to be licensed; a number also require licensing for commercial agencies. Be sure that your agency of choice is licensed where necessary, and especially in the states where your debtors reside. They should also be adequately insured and bonded, as required by law.

For more information from the CCA of A, visit their page on the certification process for commercial collection agencies.

5. Experience

How long has the collection firm been in business? How much experience does the company leadership (executive and managers) have in collections? What about the collectors – are they certified by an independent association? What is the collector turnover? These questions are key to determining if the company has enough expertise to effectively handle your most valuable asset – your customers.

6. Industry Specialization

In general, the collection process is pretty much the same across industries. There isn’t a vast difference between collecting from an importer versus collecting from a distributor or retailer. In some industries, however, such as telecommunications, media and healthcare, special regulatory conditions exist. Collectors working in areas governed by such regulations must be experts at applying them to their handling of your past due accounts. And, of course, there is a large body of both federal and state law involved in collecting from consumers. Therefore, if your industry or customer base is governed by specific rules and regulations, find a collection partner with the appropriate knowledge and experience.

7. Technology

Given the current level and availability of technology, you should expect your agency to offer some type of online access that lets you: view the status of your accounts, correspond with their collectors, and possibly even run statistical reports on your collection portfolio. If you place just a handful of claims a year, this may not be an important issue, as long as the collectors regularly update you on the status of each account. But if you have hundreds or thousands of accounts, you’ll definitely want to use an agency that provides web access to this information. Their ability to offer customized and ad hoc reports should also be a deciding factor.

8. Fee Structure

A contingent fee structure (i.e. no collection, no fee) is pretty much standard for collections around the world. In addition, most collection firms use some sort of tiered structure. Historically, fees have been based on the amount of the account if a single account, or the size of the collection portfolio, the amount collected, and the type of handling – in-house, attorney-amicable or lawsuit – required to collect. However, other factors that may be used to set rates include: the age of the account at placement, the location of the debtor, and the type of placement (manual or automated).

Many collection agencies also offer some sort of free final demand service. Under this agreement, no fees are due the agency if the debtor pays within in a specified (often 10 days) period of time. The standard for remitting collected monies back to the creditor is generally remit “net”, meaning the agency takes their and any attorney fees from the amount collected and forwards the balance to the creditor.

If you’re only placing a small number of accounts with the agency, you may not be able to negotiate any special rates. The standard fee schedules for most firms are very similar. Some firms, however, increase their rate based on the age at placement. Or, they may require an upfront placement fee for old accounts. If you have a very old (more than 12 months past-due) account, you may want to look for an agency that does not adjust its fees based on the age of the claim.

The good news is the collection industry is very competitive. So if you’ll be placing large dollar amounts or a significant number of accounts, you’ll have a lot of leverage. You should be able to negotiate a flat fee, at least for in-house collections. However, in collections, as elsewhere, you get what you pay for. So don’t take the lowest quote without a clear understanding of how the accounts will be handled. Collection firms are in business to make money, just like you are. The firm with the lowest fee may not provide the quality of service required, or meet your handling requirements.

9. Value Addition

The extras that some collection firms provide, like training programs, educational newsletters, free webinars, etc., may not seem particularly important, but don’t be too quick to ignore them. These “value adds” are often an indication of an agency’s expertise, commitment to the industry, and desire to provide quality service to their customers.

Information is Power

By exploring these nine important areas, you’ll be able to put together a good working profile of an outside collection agency that’s right for you. You’ll also be able to examine the qualifications of the various OCAs available and make a well-informed choice.

A final word: seek a partner – not just a vendor. You want a firm that not only gives you good value for your money, but also complements your culture and adds value to your relationship.

Check out these other commercial collections articles for tips and information on our website.

To learn more about our commercial collection agency services contact us today!